Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. If you still have questions or prefer to get help directly from an agent, please submit a request. A costing method used where similar items are produced continuously, assigning costs equally across all units. A Total costs to beaccounted for (step 2) must equal total costs accounted for (step4). From the auditor’s viewpoint, proper allocation is crucial for accurate financial reporting. Auditors examine the methods used to allocate overhead to ensure they are reasonable and consistently applied.

- And some of the relevant cost subcategories may be excavation, concrete, steel, wood, tiles, pipes, wires, etc.

- Once the cost per unit is identified, the company assign this cost to the finished goods units and the work in process units.

- It allows for a granular analysis of cost behavior and the identification of cost drivers.

Cost of Production Report: Unraveling the Cost of Production Report in Manufacturing

It allows for a granular analysis of cost behavior and the identification of cost drivers. For instance, a sudden increase in the cost of a particular component could signal supply chain issues or a need for vendor renegotiation. It’s the compass that guides a company through the complex waters of production turbotax deluxe 2011 federal and state returns, pc windows economics, ensuring that every decision is backed by solid data and a clear understanding of the cost implications. Before starting to prepare a cost report, it is important to clarify the scope and purpose of the report. Who are the intended audience and what are their expectations and needs?

IDBI Bank opens registration for 1000 ESO vacancies. Check direct link here

Rounding the cost per equivalent unit to the nearest thousandth will minimize rounding differences when reconciling costs to be accounted for in step 2 with costs accounted for in step 4. Understanding the Cost of Goods sold (COGS) is pivotal in grasping the full picture of a manufacturing entity’s financial health. This metric reflects the direct costs attributable to the production of the goods sold by a company. It includes material costs, direct labor, and overhead directly tied to the production process. By dissecting COGS, stakeholders can glean insights into the efficiency of production, the pricing strategy, and ultimately, the profitability of the products. It’s not just a line item on the income statement; it’s a window into the operational heartbeat of a company.

Analyzing Cost Data

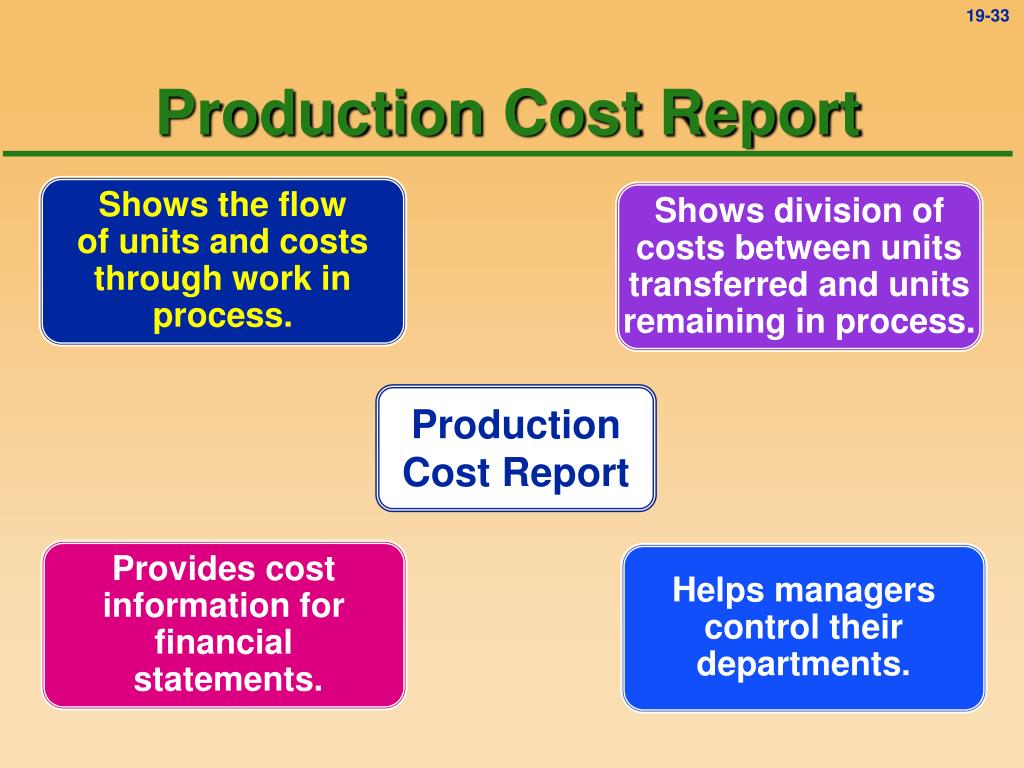

A separate cost of production report is prepared for each processing department. In a costing system when the summarized data related to the flow of costs and units is required, then the cost of production report is prepared. It is also called CPR which is similar to the job cost sheet prepared during a job order cost accounting system.

Production Cost Report Explained

By gathering cost data in a timely and accurate manner, one can ensure the quality and credibility of the cost report. After collecting the cost data from reliable and verifiable sources, the next step is to record and store the cost data in a systematic and secure manner. Systematic means that the cost data is recorded and stored in a way that is consistent, organized, and easy to access and retrieve. Secure means that the cost data is protected from unauthorized access, modification, or deletion. Some examples of systematic and secure ways to record and store the cost data are using spreadsheets, databases, software applications, cloud services, etc.

In the realm of manufacturing, strategic decision-making is a critical component that can significantly influence the success or failure of an enterprise. The cost of production data serves as a cornerstone for such decisions, providing a factual basis upon which strategies can be developed, assessed, and refined. This data encompasses a wide array of variables, from direct costs like raw materials and labor to indirect expenses such as overhead and maintenance. By dissecting this information, companies can pinpoint areas of inefficiency, identify opportunities for cost reduction, and optimize their resource allocation.

In summary, COGM is more than just a figure on the balance sheet; it’s a vital tool for financial health, operational efficiency, and strategic planning in the manufacturing sector. By analyzing COGM from various perspectives, businesses can gain valuable insights that drive informed decision-making and long-term success. It’s a vital component for any manufacturer serious about understanding and improving their production process. For those who want to add more complexfeatures, the basic data (e.g., the data in Table 4.2) can beentered at the top of the spreadsheet and pulled down to theproduction cost report where necessary. A cost report is not only a source of information, but also a tool for communication and presentation.

A well-prepared and well-presented cost report can provide valuable insights to the stakeholders, such as the project manager, the client, the sponsor, the accountant, and the auditor. In this section, we will discuss some of the best practices for preparing and presenting a cost report, as well as some of the common challenges and pitfalls to avoid. We will also suggest some of the next steps that can be taken after completing a cost report, such as reviewing the lessons learned, implementing the corrective actions, and celebrating the achievements. The cost reporting system enabled the company to identify the sources and causes of variance, such as material waste, machine downtime, labor inefficiency, and quality issues. The company then used this information to implement corrective actions, such as improving inventory management, optimizing machine settings, training and motivating workers, and enforcing quality standards.

Process Costing always follows the same process while job-order costing applies to each job separately. Describe the three groups of units that must be accounted for when using the FIFO method. The MST Manufacturing Company produces one product that passes through a single process in a manufacturing cycle lasting approximately 18 days. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.