As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. For the month of April, sales from the Blue Jay Model contributed $36,000 toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company.

What does a high or low Contribution Margin Ratio mean for a business?

The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs.

Contribution Margin Ratio: Formula, Definition, and Examples

- Let’s say your business sold $2,000,000 in product during the first quarter of the year.

- Before making any changes to your pricing or production processes, weigh the potential costs and benefits.

- In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

- Thus, 20% of each sales dollar represents the variable cost of the item and 80% of the sales dollar is margin.

- This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit.

The higher the number, the better a company is at covering its overhead costs with money on hand. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Investors examine contribution margins to determine if a company is using its revenue effectively. A high contribution margin indicates that a company tends to bring in more money than it spends.

Fixed cost vs. variable cost

This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40).

Look at the contribution margin on a per-product or product-line basis, and review the profitability of each product line. Selling products at the current price may no longer make sense, and if the contribution margin is very low, it may be worth discontinuing the product line altogether. This strategy can streamline operations and have a positive impact on a firm’s overall contribution margin.

Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases.

For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company. The contribution margin companies using xero and its marketshare (CM) is the amount of revenue in excess of variable costs. Labor costs make up a large percentage of your business’s variable expenses, so it’s the ideal place to start making changes.

Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc). If you want to reduce your variable expenses — and thereby increase your contribution margin ratio — start by controlling labor costs. Once you know that you have a net loss on your hands, you can use contribution margin ratio to figure out what you need to do to break even. But you could also increase sales by $200,000 without increasing variable expenses.

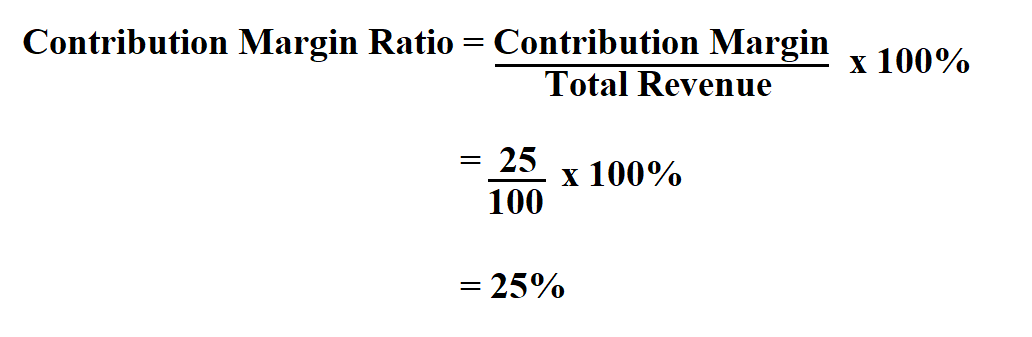

In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. As mentioned earlier, the contribution margin ratio can help businesses determine the lowest possible price at which sales can be made and still break even.

One of the important pieces of this break-even analysis is the contribution margin, also called dollar contribution per unit. Analysts calculate the contribution margin by first finding the variable cost per unit sold and subtracting it from the selling price per unit. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant.

For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits. Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%.