Figure 10.7 contains some possible explanations for the laborrate variance (left panel) and labor efficiency variance (rightpanel). DLYV can be affected by several factors, such as labor rate or wage changes, variations in employee skill levels, differences in the number of hours worked, and changes in working conditions. Calculating DLYV is important to assess the productivity of labor and identify areas where operational efficiency can be improved. Let’s say our accounting records show that the line workers put in a total of 2,325 hours during the month. As mentioned earlier, the cause of one variance might influence another variance. For example, many of the explanations shown in Figure 10.7 „Possible Causes of Direct Labor Variances for Jerry’s Ice Cream“ might also apply to the favorable materials quantity variance.

Strategies for Improving Labor Efficiency Variance

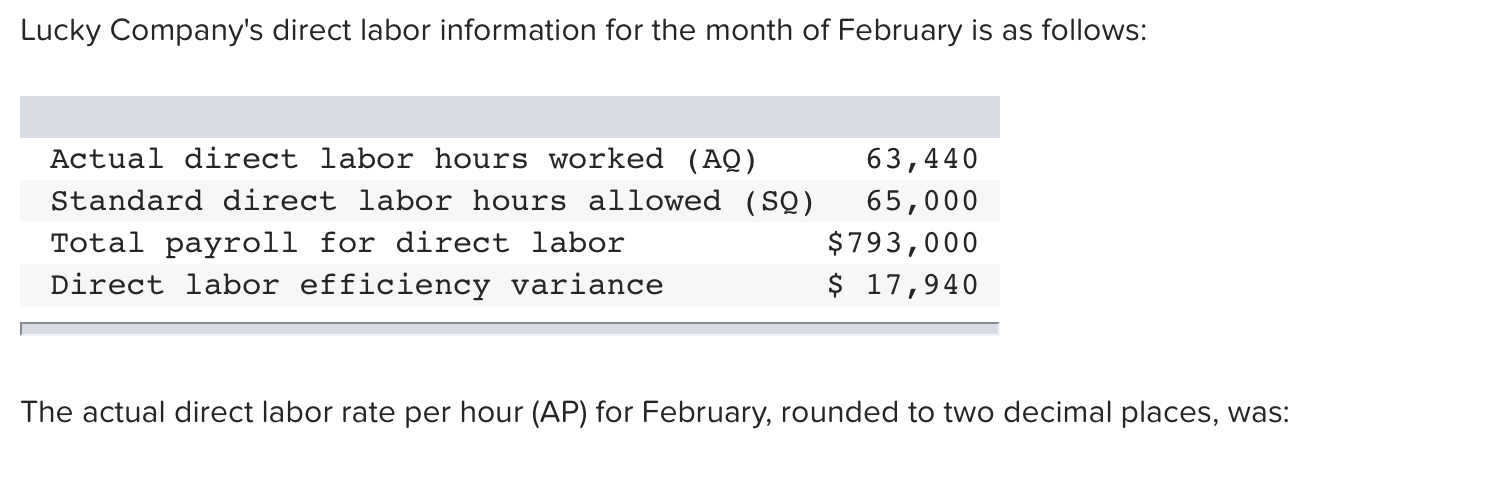

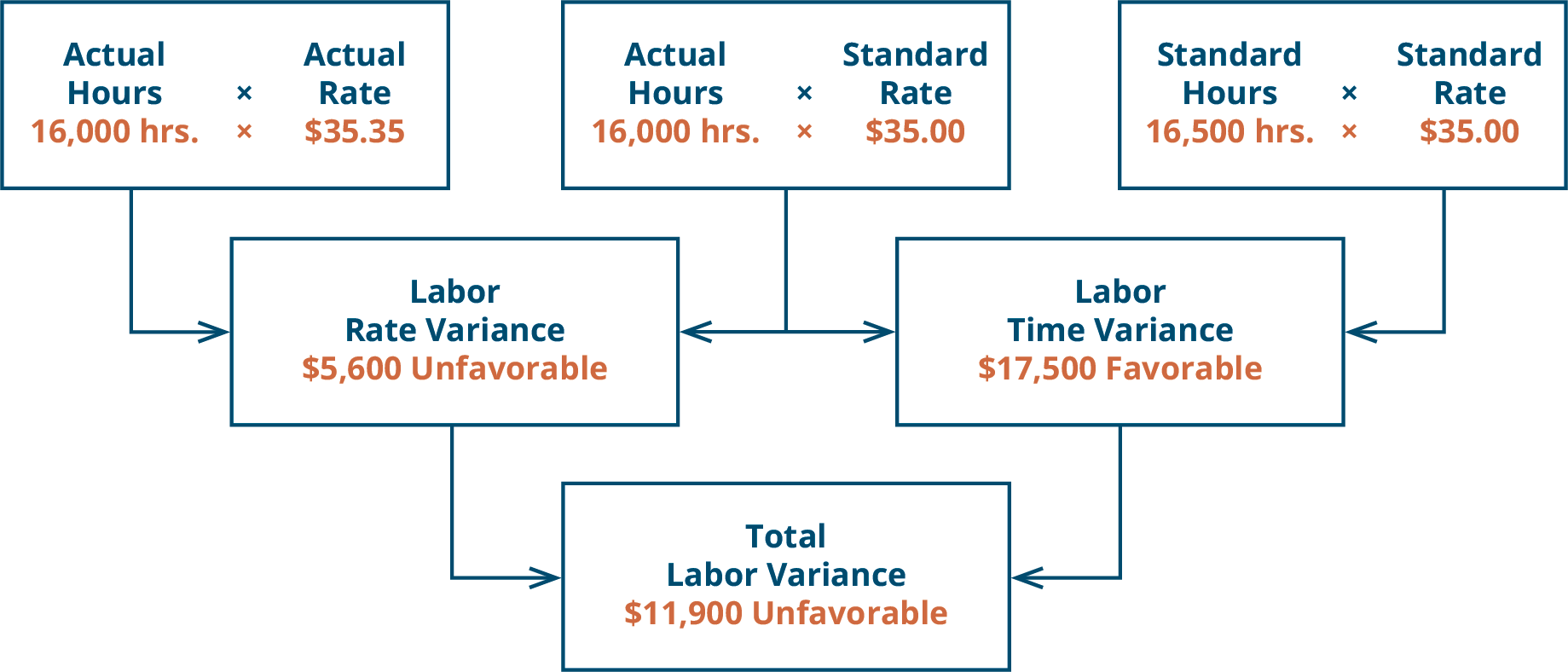

This awareness helps managers make decisions that protect the financial health of their companies. The labor efficiency variance calculation presented previously shows that 18,900 in actual hours worked is lower than the 21,000 budgeted hours. Clearly, this is favorable since the actual hours worked was lower than the expected (budgeted) hours. The actual rate of $7.50 is computed by dividing the total actual cost of labor by the actual hours ($217,500 divided by 29,000 hours). Jerry (president and owner), Tom (sales manager), Lynn(production manager), and Michelle (treasurer and controller) wereat the meeting described at the opening of this chapter. Michellewas asked to find out why direct labor and direct materials costswere higher than budgeted, even after factoring in the 5 percentincrease in sales over the initial budget.

How confident are you in your long term financial plan?

- The difference in hours is multiplied by the standard price per hour, showing a $1,000 unfavorable direct labor time variance.

- The human resources manager of Hodgson Industrial Design estimates that the average labor rate for the coming year for Hodgson’s production staff will be $25/hour.

- The net direct labor cost variance is still $1,550 (favorable), but this additional analysis shows how the time and rate differences contributed to the overall variance.

- United Airlines asked a bankruptcy court to allow a one-time 4 percent pay cut for pilots, flight attendants, mechanics, flight controllers, and ticket agents.

- The actual amounts paid may include extra payments for shift differentials or overtime.

The reason is that the highly experienced workers can generally be hired only at expensive wage rates. If, on the other hand, less experienced workers are assigned the complex tasks that require higher level of expertise, a favorable labor rate variance may occur. However, these workers may cause the quality issues due to lack of expertise and inflate the firm’s internal failure costs. In order to keep the overall direct labor cost inline with standards while maintaining the output quality, it is much important to assign right tasks to right workers.

Direct Labor Time Variance

Ultimately, understanding and managing labor variances are essential for maintaining financial health and operational efficiency. This results in an unfavorable labor efficiency variance of $4,000, indicating that the company used 200 more hours than expected, incurring an additional $4,000 in labor costs. If customer orders for a product are not enough to keep the workers busy, the production managers will have to either build up excessive inventories or accept an unfavorable labor efficiency variance. The first option is not in line with just in time (JIT) principle which focuses on minimizing all types of inventories.

Explanation of Direct Labor Variance

Factors such as wage increases, differences in pay scales for new hires versus seasoned employees, and merit-based raises can impact the actual hourly rate, leading to a labor rate variance. For Jerry’s Ice Cream, the standard allows for 0.10 labor hours per unit of production. Thus the 21,000 standard hours (SH) is 0.10 hours per unit × 210,000 units produced. For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production. Thus the 21,000 standard hours(SH) is 0.10 hours per unit × 210,000 units produced. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate.

Doctors, for example, have a time allotment for a physical exam and base their fee on the expected time. Insurance companies pay doctors according to a set schedule, so they set the labor standard. If the exam takes longer than expected, the doctor is not compensated for that extra time.

Well-trained workers and effective supervision can enhance productivity, leading to favorable labor efficiency variances. Inadequate training or poor supervision can result in inefficiencies and unfavorable variances. If the actual rate is higher than the standard rate, the variance is unfavorable since the company paid more than what it expected. The combination of the two variances can produce one overall total direct labor cost variance. Direct Labor Yield Variance (DLYV) is a measure of the difference between actual and expected labor costs, based on the number of units produced or services provided. Outcome By addressing these issues, Company A was able to reduce its unfavorable labor rate variance significantly in subsequent quarters, achieving better cost control and financial stability.

Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output. In this question, the Bright Company has experienced a favorable labor rate variance of $45 because it who can i claim as a dependant on my tax return has paid a lower hourly rate ($5.40) than the standard hourly rate ($5.50). We have demonstrated how important it is for managers to be aware not only of the cost of labor, but also of the differences between budgeted labor costs and actual labor costs.

The engineering staff may have decided to alter the components of a product that requires manual processing, thereby altering the amount of labor needed in the production process. For example, a business may use a subassembly that is provided by a supplier, rather than using in-house labor to assemble several components. A labor standard may assume that a certain job classification will perform a designated task, when in fact a different position with a different pay rate may be performing the work. There are a number of possible causes of a labor rate variance, which are noted below. An overview of these two types of labor efficiency variance is given below. Kenneth W. Boyd has 30 years of experience in accounting and financial services.

Daniel S. Welytok, JD, LLM, is a partner in the business practice group of Whyte Hirschboeck Dudek S.C., where he concentrates in the areas of taxation and business law. Dan advises clients on strategic planning, federal and state tax issues, transactional matters, and employee benefits. He represents clients before the IRS and state taxing authorities concerning audits, tax controversies, and offers in compromise. He has served in various leadership roles in the American Bar Association and as Great Lakes Area liaison with the IRS. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.